ONSIGNA KASH

About Us

Onsigna KASH, A LATAM leader with multi-local presence is an innovative fintech specializing in payment services. We encourage financial inclusion as a key enabler for developing underserved and underbanked communities.

KASH offers specific-purpose payment solutions to commercial, retail and end users. A single connection to our multi-layer technology platforms or devices provides our partners with a seamless API allowing a complete end-to-end service.

In order to remain relevant and keep on an upward trajectory we strive for expanded volume while incorporating the latest technologies to provide an expanding base of products and services for our customers.

Fully operational:

United States (Acquiring/Issuing)

Mexico (Acquiring/Issuing)

Argentina (Acquiring/Issuing)

BACKGROUND

The Foundation

1999 – 2004

Our founder has more than 20 years of experience in the cross-border telecommunications and technology markets.

In 1999, the company Zybercom Corp. was created, a company dedicated to offering Telecommunications and Technology solutions to customers through prepaid phone cards.

The Group began to develop its activity in rural and regional areas. In 2002, the rest of the country was opened. We developed the most relevant network with the greatest coverage for long distance telephony in the Mexico/USA market.

2011 – 2017

In 2011, COFETEL gave us permission to establish, operate and exploit a Telecommunications Concesion license.

In 2011, the partners created Onsigna Holdings merging, several synergies.

Since 2017, Onsigna entered into financial services, taking advantage of its wide network of allied companies and deep knowledge of the cross-border market.

In 2017, we obtained a License as a Money Transmitter and expanding the venture into financial services with a focus on sub-banking sectors.

2018 – 2019

We emphasized our main objectives to contribute to financial inclusion, introduce more users to the formal financial system, including the millions of Mexicans in Mexico and the United States.

2019 – 2020

In Process of: Principal Member- BIN Sponsor

Developing: Payment System – Mobile Onsigna and digital APP: KASH Pay

Establish a processing relationship

Correspondent Network – cash in / cash out / and payment processing

Mission & Vision

MISSION

We are committed, through innovative technologies and tools, to offer the best alternatives as an enabler and provider of integral solutions for our financial services clients..

VISION

To be recognized as the most reliable Enabler, with agile and innovative solutions, to provide access to a range of financial products and services that meet and exceed user expectations.

Our Values

RESPONSABILITY

We are a diverse team that assumes its obligation individually and collectively.

PASSION

We are passionate in everything we do.

INTEGRITY

We subscribe to the highest ethical standards.

TEAMWORK

We are a team with shared goals and we have open communication.

PROACTIVITY

We anticipate and prevent problems so we take advantage of opportunities before others.

INNOVATION

We value the diversity of ideas, thoughts and opinions of our people to achieve creative solutions that impact business results.

COMMUNITY COMMITMENT

It’s not always about us, we work for the common good.

I want to issue cards and credentials

To launch a card program, you’ll need a banking relationship, an issuer processor and likely a program manager.

VISA BIN SPONSOR AND MASTERCARD ICA SPONSOR

A BIN/ ICA sponsor is the issuing bank that owns the BIN/ICA, which is necessary to access the Visa and MasterCard network. The issuing bank holds cardholder funds and takes on the role of managing risk and local country regulations, adhering to Visa and MasterCard rules and often acting as the settlement agent.

VISA BIN SPONSOR AND MASTERCARD ICA SPONSOR

Your direct connection to the issuing bank and networks, issuer processors keep the system of record, manage issuance, authorize transactions and communicate with settlement entities.

PROGRAM MANAGERS

Oversees your card program on the issuing bank’s behalf – establishing key relationships, marketing to consumers and merchants, and helping to support profitability. They are typically responsible for developing, launching and managing the program through its lifecycle.

END-TO-END PARTNERS

These partners offer the full-stack issuing solution that includes BIN/ICA sponsorship, issuer processing as well as program management – often outsourcing some capabilities but providing a unified development interface. Not available in all regions.

I WANT TO ENABLE DISBURSEMENTS

We’ve done the hard work to enable funds disbursements, peer-to-peer payments, payroll disbursements and other fast payment use cases.

KASH Partners

Your link to KASH funds delivery processing with businesses and solution providers for empowering direct payments using card credentials.

I WANT TO FIND A CERTIFIED SOLUTION

If you’re looking to quickly integrate specialized capabilities, KASH partners have the expertise and solution for you.

KASH Certified Partner

Ease your way into the payment ecosystem. KASH Certified Partners can help enable fast adoption of payment solutions by merchants, technology and financial institutions.

KASH connects, partners, consumers, and merchants to our leading digital services and payment platform providing among other the following services:

To launch a card program, you’ll need a banking relationship, an issuer processor and likely a program manager.

- Cash deposits-(cash in)

- Receive money-(cash out)

- Card to card transactions

- ACH, SPEI, SWIFT

- International (swift)

- Domestic (clave)

- Checking accounts

- Virtual or physical card – VISA/ MasterCard with international payment function

- Mobile airtime and Mobile data plan top-up

- Bill Payments- (pay bills)

- Merchant Service- mpos/ reader and/or QR code payment

- Payments to Suppliers-(merchant option)

- Third party company for automatic payment

- In-App Payment

- Mini-program app payments

- Settlement and clearing

- Person-to-person payment-(transfers)

- Cross-border payment- bank account; KASH card; merchant websites

- Third party payment solutions- cash out locations

- Onboarding Process

- Pooling accounts

- DDA/DBA accounts

- KASH kPOS is a MERCHANT mobile point of sale with a Bluetooth-enabled reader, that processes mag-stripe, chip and QR codes payments. Also, keeps track of every transaction and receipts.

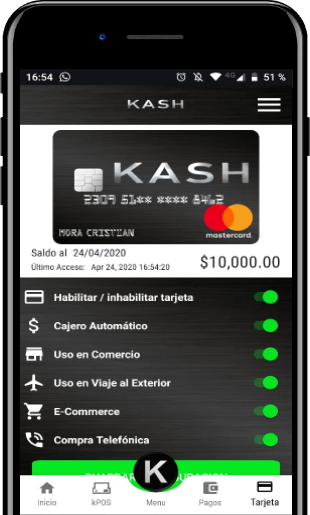

A digital wallet (mobile web portal) is a software-based system that securely stores users’ payment information.

KASH WALLET

Compliance

One of the hallmarks of Onsigna’s international program is strict adherence to all compliance requirements in all jurisdictions. We are acutely aware of who we deal with, both in our partnerships and in our customers. We institute the following: A completely transparent and vigorous onboarding process within strict KYC parameters. Commercial customers undergo strict OFAC/CFT examination Maintenance of low load values prohibiting violation of our AML policies. Constant 24/7 system wide monitoring. Immediate updating of all systems for new or changed regulations and requirements.

Endorsed and supervised by Joint Societies

Onsigna is a licensed Mexican Institution, its partners form a group structure that includes participants from various financial sectors, approved, regulated and supervised by the National Banking and Securities Commission (CNBV) in Mexico with corresponding authority in relevant jurisdictions. Together this allows us to develop and operate any type of debit, credit or prepaid card program.

Onsigna as Sponsor BIN manager can offer comprehensive and customized payment solutions that promote the development of third-party financial entities, non-regulated entities and public sector organizations that seek to offer financial products and services to different segments of the population.